Core Billing Tools

DrChrono provides many tools for you to effectively and efficiently process your claims and keep up-to-date on your financials.

Here is a quick introduction to the various tools available to you.

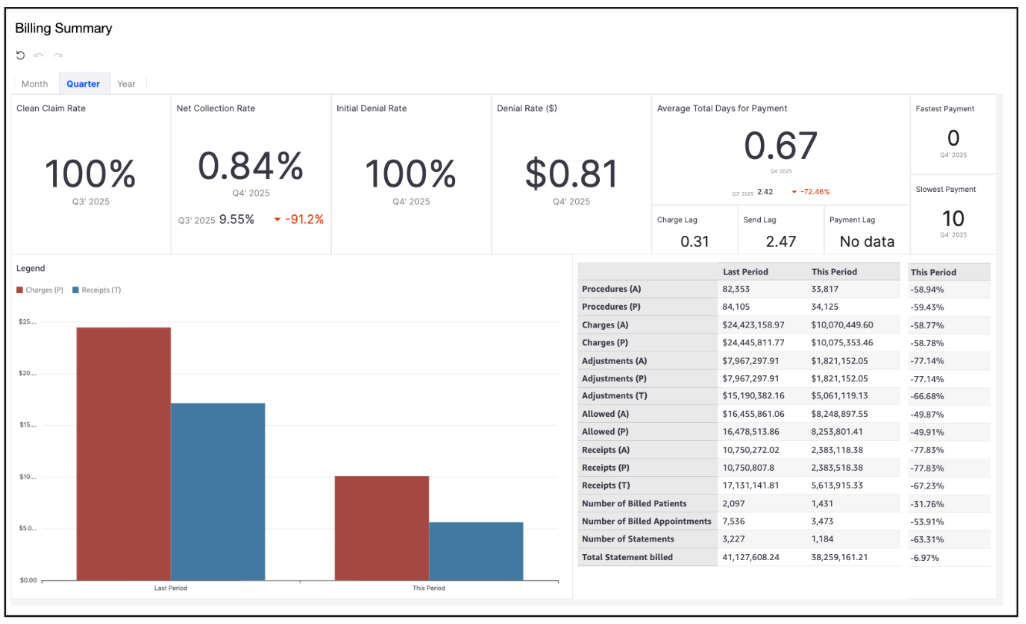

Billing Summary

- Navigate to Billing > Billing Summary

The Billing Summary report provides a clear overview of key performance metrics across monthly, quarterly, and yearly timeframes.

It includes measures such as Clean Claim Rate, Net Collection Rate, Initial Denial Rate, Denial Rate (in dollars), Average Total Days for Payment, Charge Lag, Send Lag, and Payment Lag.

A dynamic bar chart also allows you to compare charges and payments for the selected period.

When the Month tab is open, the information shown will be for the current and previous month.

When the Quarter tab is open, the information shown will be for the current and prior quarter.

When the Year tab is open, the information shown will be for the current year and the prior year

Live Claims Feed

- Navigate to Billing > Live Claims Feed

The Live Claims Feed is a convenient and comprehensive way to keep track of all your claims beginning when the appointment is first scheduled.

To navigate the live claims, you have access to several filters to narrow the range you are examining.

Claim Status Filter:

- ERA Received: A response has been received via ERA from the payer, however, at least 1 item on the claim needs manual review. Additional details can be found within the actual appointment by pressing on the green words ERA Received.

- In Process at Clearinghouse: The claim has been received at the clearinghouse and is being scrubbed before sending it to the payer.

- In Process at Payer: The payer has received the claim from the clearinghouse and is conducting an upfront scrub of the claim before accepting it into their system for processing.

- Payer Acknowledged: The payer has accepted the claim into their system for processing.

- Coordination of Benefits: The claim has been processed by the patient's primary insurance and is now with the patient's secondary insurance for consideration.

- Other: These are claims that are in other statuses, including Paid in Full, Faxed/Mailed Claim or Appeal, Balance Due, and Pending Info Practice among others. Details for these claims can be found under Billing St, just to the right of the Claim St. Billing > Live Claims Feed > Billing St

- Rejected: Upfront rejection. If you press on the blue Rejected Payer within the appointment, you will be able to see additional information regarding the denial. This claim has not made it into the payer's system for processing.

- ERA Denied: The claim has been processed by the payer, however, there is a portion(s) that has been denied. Details on the denial can be found on the actual ERA posting within the appointment.

- Not Submitted: These are appointments for which there is no status. The claim has not been billed to insurance. This could include appointments from the current or future dates.

- Missing Information: Upfront rejection for information that is imperative to submit the claim. Additional information on the rejection and clarity on what information is missing can be seen by pressing on the blue missing information words within the appointment.

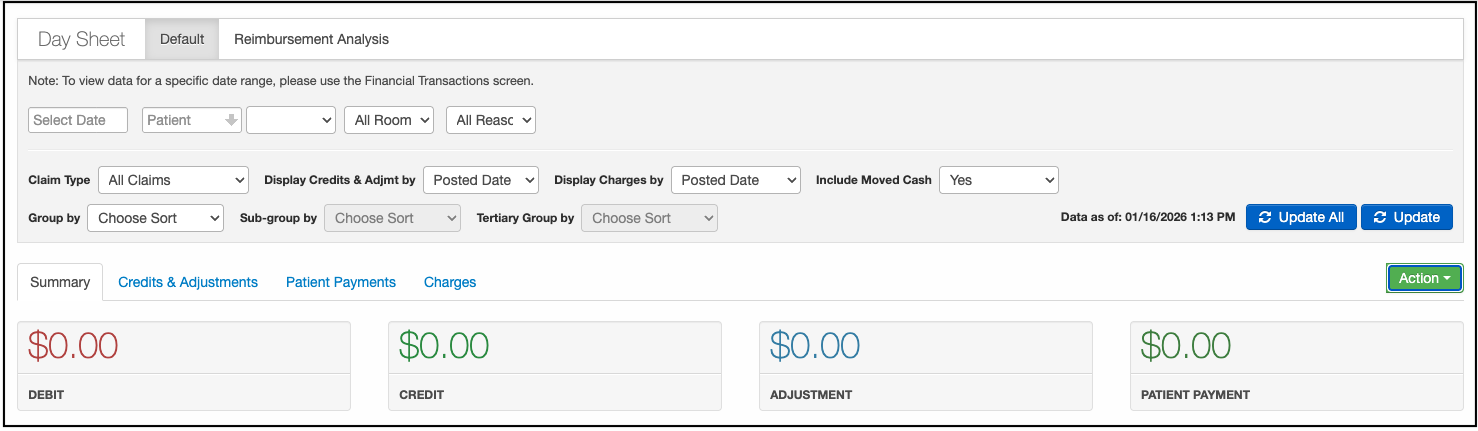

Day Sheet

- Navigate to Billing >Day Sheet

The Day Sheet is designed to provide a day-to-day snapshot of your finances, detailing charges, payments/credits, and adjustments. The day sheet provides a more macroscopic view of your practice. It allows you to keep track of your Debits (Total Charges), Credits (Amount Collected From Insurance), Adjustments (Insurance Adjusted Amount), and Patient Payments (Paid By Patient).

Aging AR Analysis

- Navigate to Billing >Aging AR Analysis

Significant enhancements have been made to the Aging Accounts Receivable (AR) Analysis Report, providing users with a more comprehensive and intuitive view of outstanding balances. These improvements offer greater clarity and transparency into the monies owed to your practice by both insurance payers and patients, enabling you to quickly identify aging claims, monitor payment trends, and prioritize follow-up efforts for faster reimbursement and improved cash flow management.

Fee Schedule

- Navigate to Billing > Fee Schedule

The fee schedule is where you can add prices for the services you offer. These services can be added as CPT/HCPCS code or a custom procedure. NDCs can also be added to any drug codes you bill out to assist during the billing process. This NDC would need to be updated if anything changes (i.e. multi-use vial to single-use) that would result in a change in NDC.

During an appointment, you can attach any of the CPT/HCPCS/custom codes to the appointment and they will reflect the price that is currently listed in the fee schedule. You can add items such as modifiers, taxes, expected reimbursement by payer, and picklist information to further customize your fee schedule.